The New Brunswick Innovation Foundation has fleshed out the strategy it outlined three years ago to develop an integrated ecosystem for launching and financing startups in the province.

At the New Brunswick Startup Outlook in Fredericton on Tuesday, the organization’s CEO Jeff White discussed its investment history and its strategy for the future. The outlook provided details of a strategy first revealed in November 2022.

It includes plans for a New Brunswick Growth Fund, which would invest in Series A rounds, and a provincial strategy for business accelerators and incubators, or BAIs. He also said NBIF would continue to invest in New Brunswick startups, both directly through its own VC funds and indirectly by backing other funds.

“We’re on a mission to stimulate the creation and growth of tech companies in our province – accelerating innovation, investing in New Brunswick tech companies, creating global impact,” said a slide accompanying White’s presentation.

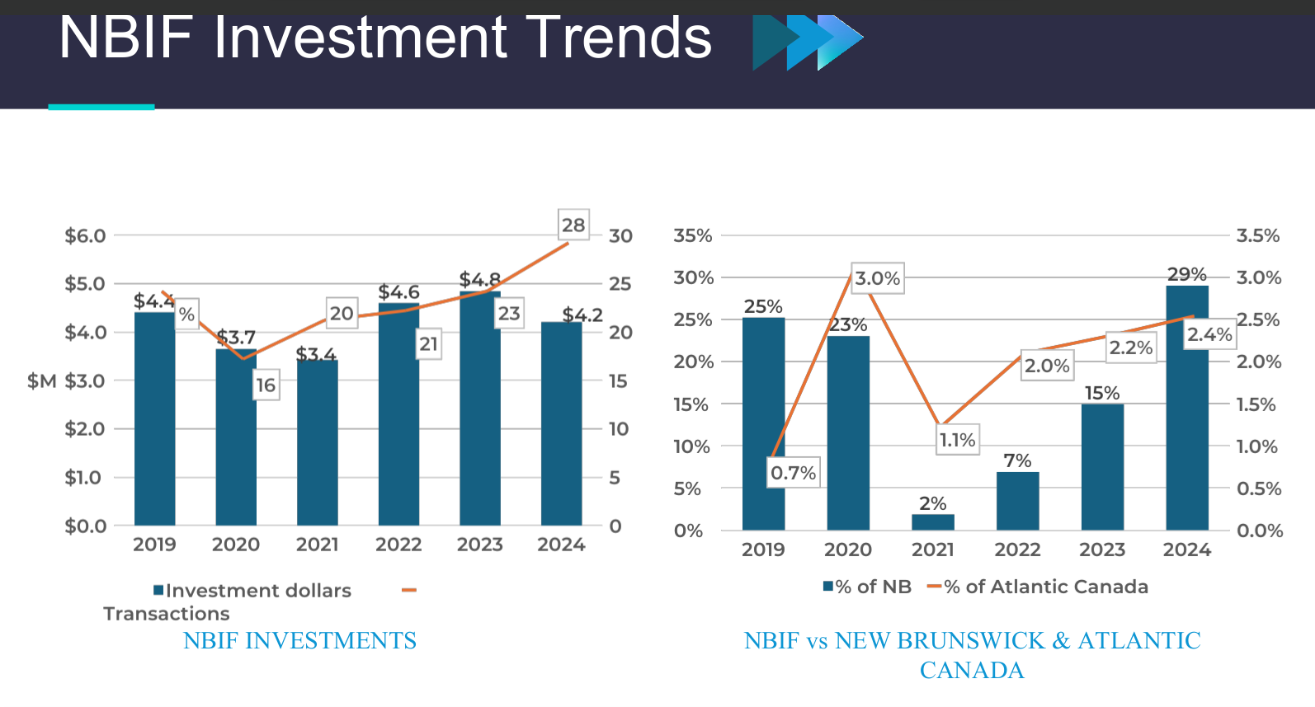

The non-profit organization’s main mission is to oversee evergreen funds that back New Brunswick startups, and has focused largely on early-stage financing. In the fiscal year ending March 31, 2024, NBIF invested a total of $4.2 million in 28 transactions for an average investment of $150,000.

To help growth-stage companies, the organization is working on the launch of the New Brunswick Growth Fund, which will invest in companies that have traction and need to raise multi-million-dollar rounds. The thinking is that if a New Brunswick body shows a willingness to participate in these rounds, it will make it easier for the province’s best companies to close Series A rounds. White said there is a gap in the ecosystem without such a fund.

The fund has been on the drawing board for a few years and White said NBIF will now begin to focus on it more. It is working on a market-driven strategy to assess the size, timing, structure and participants of such a fund. It is designed to complement the strategy of direct early-stage investment, backing other funds and developing a network of BAIs.

As of the end of the 2024 fiscal year (the most recent data available), NBIF has invested $24 million in 42 companies, which have collectively raised $706 million from other sources.

“This does not include NBIF’s 17 exits which have generated hundreds of millions in capital investment – much of which has been reinvested back into the provincial economy, including a number of companies in NBIF’s current portfolio,” said NBIF.

White said his organization has also been mindful of the need to develop the pipeline of new companies, and it keeps data on new companies that appear on its radar each quarter. The organization was worried that it could find only three new companies in the first quarter of calendar 2024, but things improved with 54 new companies approaching NBIF in the final nine months of the year. In the first quarter of 2025, the foundation identified 23 new companies.